What is a budget and why make one?

A budget is the act by which we plan the earnings and planned expenses over a certain period. Evaluating income and expenses allows us to maintain control over our financial life.

This will help you not be “in the red” at the end of the month and will help reduce your stress.

Different reasons can lead us to make a budget: to pay off a debt, to finance the purchase of a car, to save for unforeseen events, to reduce your expenses, etc.

How to make a budget?

To make a good budget, you must take into consideration income and expenses. Expenses should not exceed income.

You must also decide how often you want to do your budget (week or month). You need to make a budget that meets your needs. There are different types of expenses: weekly expenses, monthly expenses, annual expenses, savings, etc.

Some expenses are fixed and recur on a regular basis (week, month, year). They are usually easy to plan: rent amount, car loan, etc.

There are also variable expenses. These are expenses whose amount can change over time such as groceries, clothing, etc.

What are the steps to making a budget?

Several tools are available for creating a budget. We offer you a simple 3-step process.

Identify your earnings and expenses

Make a list of your income: pay, bonuses, allowance, etc.

Identify all of your expenses: rent amount, insurance, amount for groceries, cell phone bill, restaurant, etc.

Even if it seems difficult, it is essential to write down all your expenses.

To help you, keep your receipts when you make a purchase, even for the small coffee purchased at the local convenience store!

Once a week, count your expenses and write them down. You can use a computer document that will do the totals automatically or write them down manually in a table.

At the end of the month, check your bank statement and credit card statement to see if you missed any expenses.

Structuring your budget

Consider including all spending categories in your budget. To help you pay your annual bills (e.g. driving license, registration, etc.), you can divide the amount of these bills by 12 and put the amount in a savings account.

Assess your finances and go over your budget.

Once the budget is established, it is important to keep it up to date. So, you have to think about adding new income and new expenses.

It is advisable to monitor and review your budget every 3 months to check that what has been planned is still realistic.

You have established your budget and it has been revised, now you must respect it and continue to improve it over time. To help you, ask yourself a few questions during your revisions:

- Is there a big difference between my actual spending and what I planned?

- Are there big differences in certain categories? If so, is this due to an unforeseen event or should I increase expenses related to this category?

- Am I saving?

- Have I planned to repay my debts?

What goals can I set myself for my budget?

- Keep all my purchase receipts

- Put $10 per week in a savings account

- Pay off my credit card balance within 3 years

- Create an emergency fund (the equivalent of 3 months of expenses)

- Reduce my expenses by 5%

Set your goals!

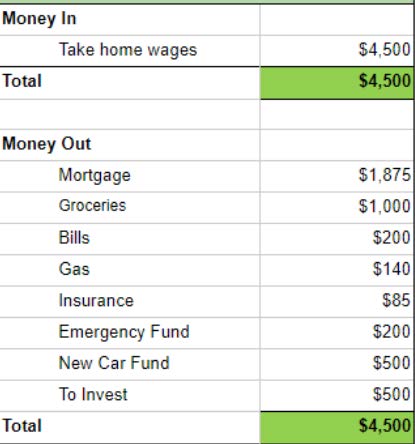

What can a budget look like?

There are several budget models, but we offer one that is easy to adjust to meet your needs.

Documents

Documents Infographics

Infographics External help

External help